Beneficial

Access our easy and rapid services anywhere. A single document completes your application

Access our easy and rapid services anywhere. A single document completes your application

Trust our direct lending with a new twist. Your data is secure, and we're there in difficult times

Simple home-based solutions quickly. Funds transferred immediately with flexible loan durations

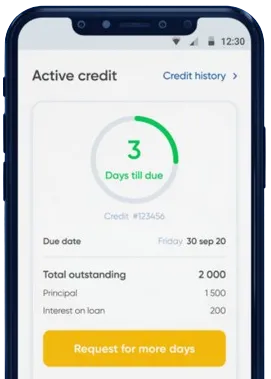

Submit an application via our app. Just fill out a simple form.

Await approval. Decisions are typically made within 15 minutes.

Receive your money, typically transferred within a minute.

Submit an application via our app. Just fill out a simple form.

Download loan app

As the financial landscape in Nigeria continues to evolve, the emergence of instant loan apps has provided individuals with easier access to credit. These apps have gained popularity due to their convenience, speed, and flexibility in providing financial assistance to users.

Quick Approval: Instant loan apps in Nigeria offer fast approval processes, allowing users to access funds within minutes. This is particularly helpful in emergency situations where immediate financial support is needed.

Minimal Documentation: Unlike traditional banks that require extensive paperwork, instant loan apps have streamlined the application process by eliminating the need for physical documentation. Users can simply provide basic information and upload necessary documents online.

Accessible Anytime, Anywhere: One of the key advantages of instant loan apps is the convenience they offer. Users can apply for loans from the comfort of their own homes or while on the go, without the need to visit a physical branch.

Customizable Loan Options: Instant loan apps in Nigeria provide users with a range of loan options to choose from based on their needs and preferences. Whether it's a small amount for personal expenses or a larger sum for business investment, users can find the right loan for their situation.

Financial Emergencies: Instant loan apps in Nigeria are particularly useful during financial emergencies such as unexpected medical expenses, car repairs, or urgent bill payments. Users can quickly obtain the necessary funds to address these situations.

Investment Opportunities: For entrepreneurs and small business owners, instant loan apps can serve as a valuable source of capital to fund business growth or expansion. The quick approval process and flexible loan options make it easier to access funding for business endeavors.

Debt Consolidation: Instant loan apps can also be used to consolidate existing debts and manage finances more effectively. Users can consolidate multiple debts into a single loan with lower interest rates, making it easier to repay and improve financial stability.

While instant loan apps offer numerous benefits, users should also be aware of the risks involved. It's important to carefully review the terms and conditions of the loan, including interest rates, repayment schedules, and any additional fees. Failure to repay the loan on time can result in penalties and damage to credit score.

Users should also exercise caution when sharing personal and financial information online. It's essential to choose reputable instant loan apps that prioritize data security and privacy to protect sensitive information.

Overall, instant loan apps in Nigeria provide a convenient and efficient way for individuals to access credit when needed. With quick approval processes, customizable loan options, and accessibility anytime, anywhere, these apps offer practical solutions for financial needs. However, users should also be mindful of the risks involved and ensure responsible borrowing practices to maintain financial health.

Yes, most instant loan apps in Nigeria have minimal eligibility criteria. As long as you are a Nigerian citizen with a valid bank account and phone number, you can apply for a loan through the app.

Once your loan application is approved, you can typically receive the funds in your bank account within minutes or hours, depending on the loan app.

The maximum loan amount varies depending on the loan app. Some apps offer loans ranging from ₦5,000 to ₦500,000 or more.

It is essential to read the terms and conditions carefully before applying for a loan to understand any fees or charges. Most reputable loan apps in Nigeria are transparent about their fees.

If you are unable to repay the loan on time, you may incur additional fees or penalties. It is crucial to communicate with the loan app's customer service team to discuss potential options for repayment.

Most instant loan apps in Nigeria use encryption and other security measures to protect your personal and financial information. It is essential to choose a reputable and secure app when applying for a loan.